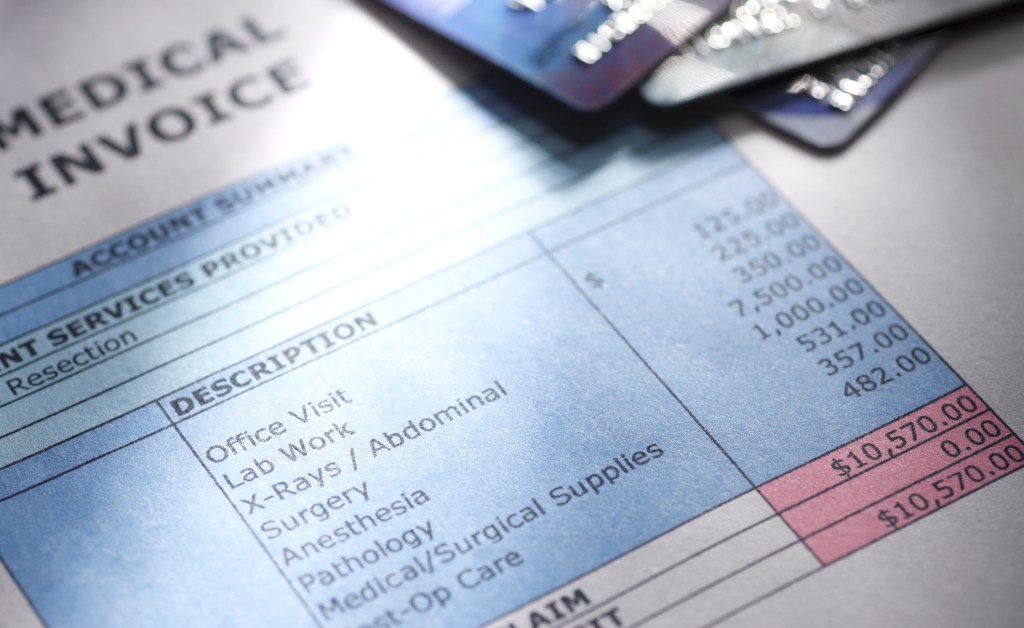

Health care debt is a persistent financial problem for many: More than 100 million Americans are estimated to owe money due to health-related bills. But according to a new study published in the Jama Health Forum, there’s a simple way to help ease the financial burden of medical debt: making a phone call.

Most people who reached out to a billing office reported “financial relief, bill corrections, or better understanding of the bill,” the study found. Selected from the Understanding America Study, 1,135 adults from across the U.S. were surveyed, with 1 in 5 respondents replying that they had received a medical bill in the prior 12 months that they either did not agree with or could not afford.

Of those who had received a problematic bill and contacted a billing office, most received positive results; 25.7% reported bill corrections, 18.2% reached a better understanding of their bill, 15.5% got set up on a payment plan, 15.2% were given a price drop, 8.1% were able to get financial assistance, and 7.3% received a cancellation of their bill. Some respondents reported multiple outcomes, per a press release from the USC Schaeffer Center.

Based on the findings, making a call — being that squeaky wheel — could help patients lower or better understand their medical debt. “Many people are hesitant to pick up the phone to question the accuracy of a problematic medical bill or explore financial options, but our findings indicate it’s worthwhile and typically takes less than one hour,” lead study author Erin L. Duffy said in a statement.

The majority of people who contacted a billing office did so by phone, with most respondents expressing that they were comfortable communicating with representatives and were treated with respect. For many, making the call took less than an hour and made a meaningful difference, according to researchers.

The respondents who did not reach out about their bills were asked why, with 86.1% responding that they didn’t think their effort would make a difference. Researchers reported that those without a college degree, having lower financial literacy, and the uninsured were less likely to reach out to billing offices.

Study findings noted that “differences in self-advocacy may be exacerbating socioeconomic inequalities in medical debt burden,” as those with lower levels of education and financial knowledge and the uninsured were less likely to advocate for themselves. Personality type also made a difference — researchers found that those who were more extroverted and had a less “agreeable” personality type, based on the Big Five Personality Test, were more likely to reach out about medical bill issues.

In an editorial for The Conversation, Duffy explains that while some progress has been made in medical care price transparency, as well as to policies and practices that reduce the burden of accessing financial aid or provide tools that help navigate medical bills, the system still needs improving.

Another study published in March looked into a random sample of 670 U.S. hospitals and found that 87% of them offered payment plans, but only 22% had plan details on their websites. In yet another paper, researchers who called in as “secret shoppers” looking for health care services found that information, while available, was difficult to access.

So although it may feel uncomfortable, as things are, you may have to do some of the work yourself.

RELATED: Diverse Nurse Workforce Linked to Improved Maternal Health Outcomes: Study

“Current health care billing practices generally require patients to practice a lot of self-advocacy, and those who cannot self-advocate well are missing opportunities for financial relief,” Trish said in the USC release. “Simpler billing processes and more transparency about financial options could make the system work better for patients.”

Whether it’s because you don’t understand your bill, there’s a billing mistake, or you need financial aid or a payment plan, making a phone call could get you the help you seek. If you can’t work up the courage to do it, Trish advises turning to an extroverted or less “agreeable” person you trust to do it for you.

Take the pro tip — make the call.